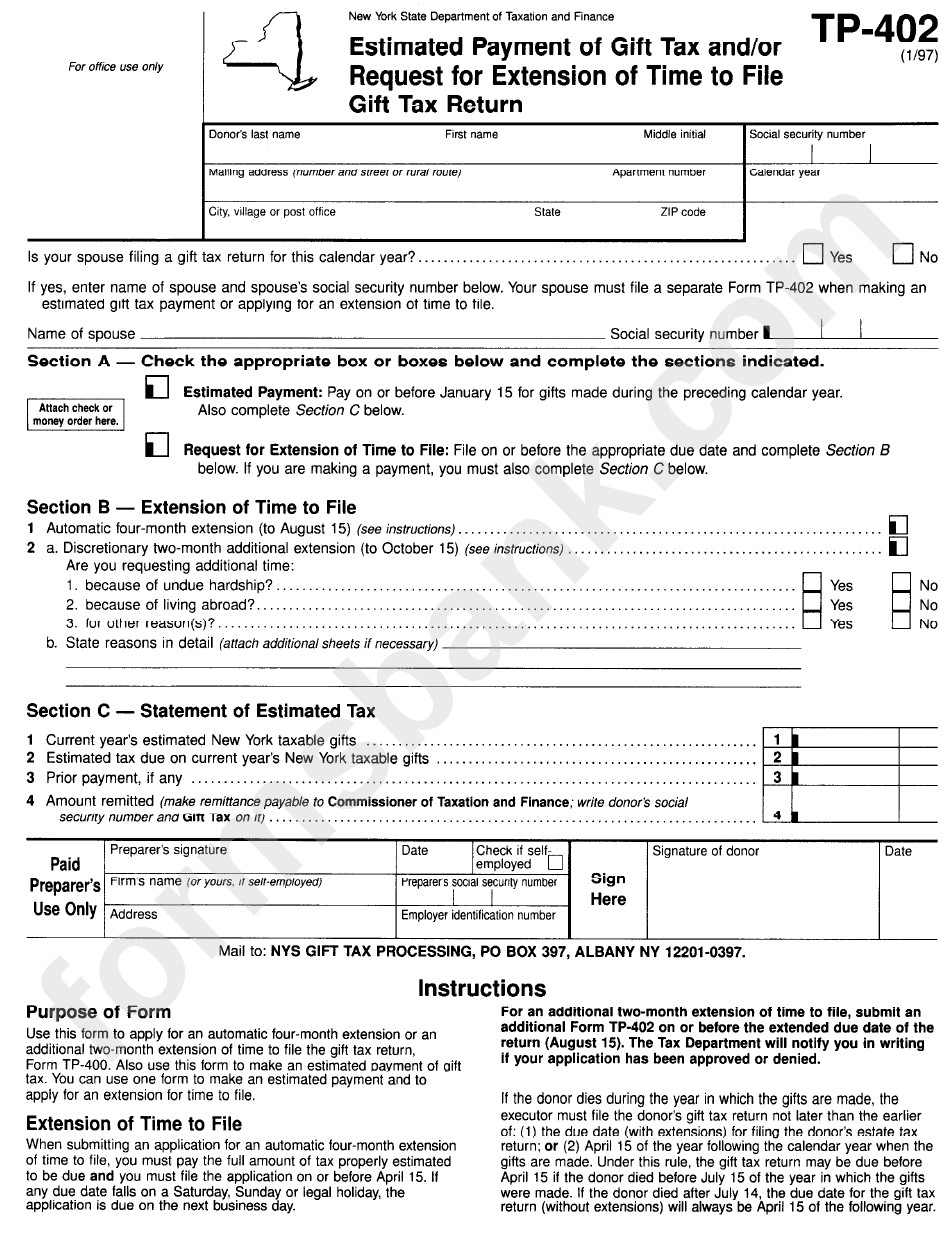

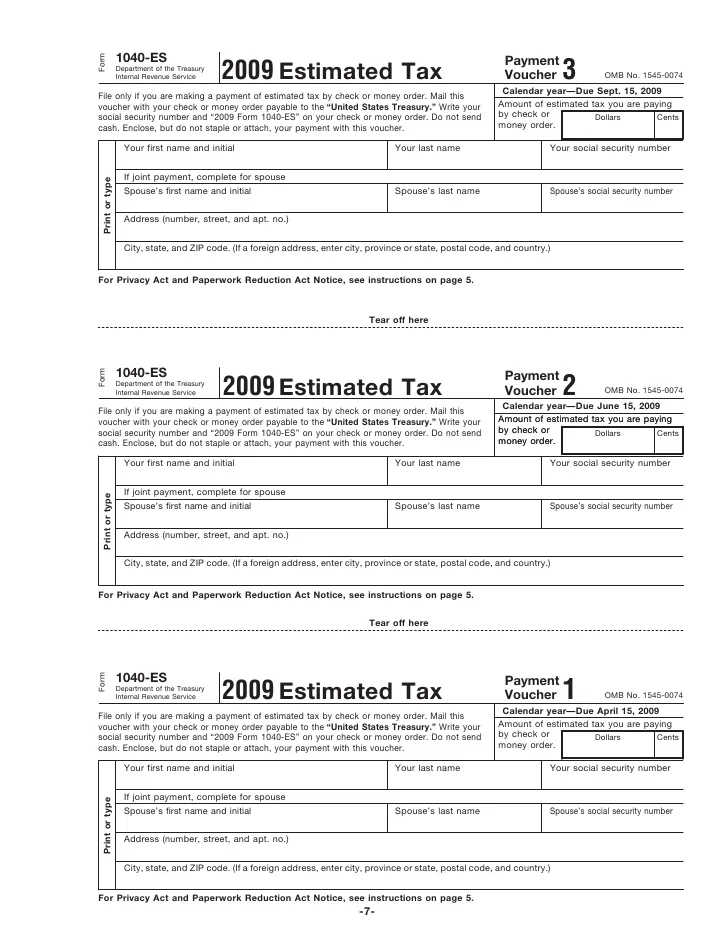

New York Estimated Tax Payments 2025. Go to screen 6, 20xx estimated tax payments. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

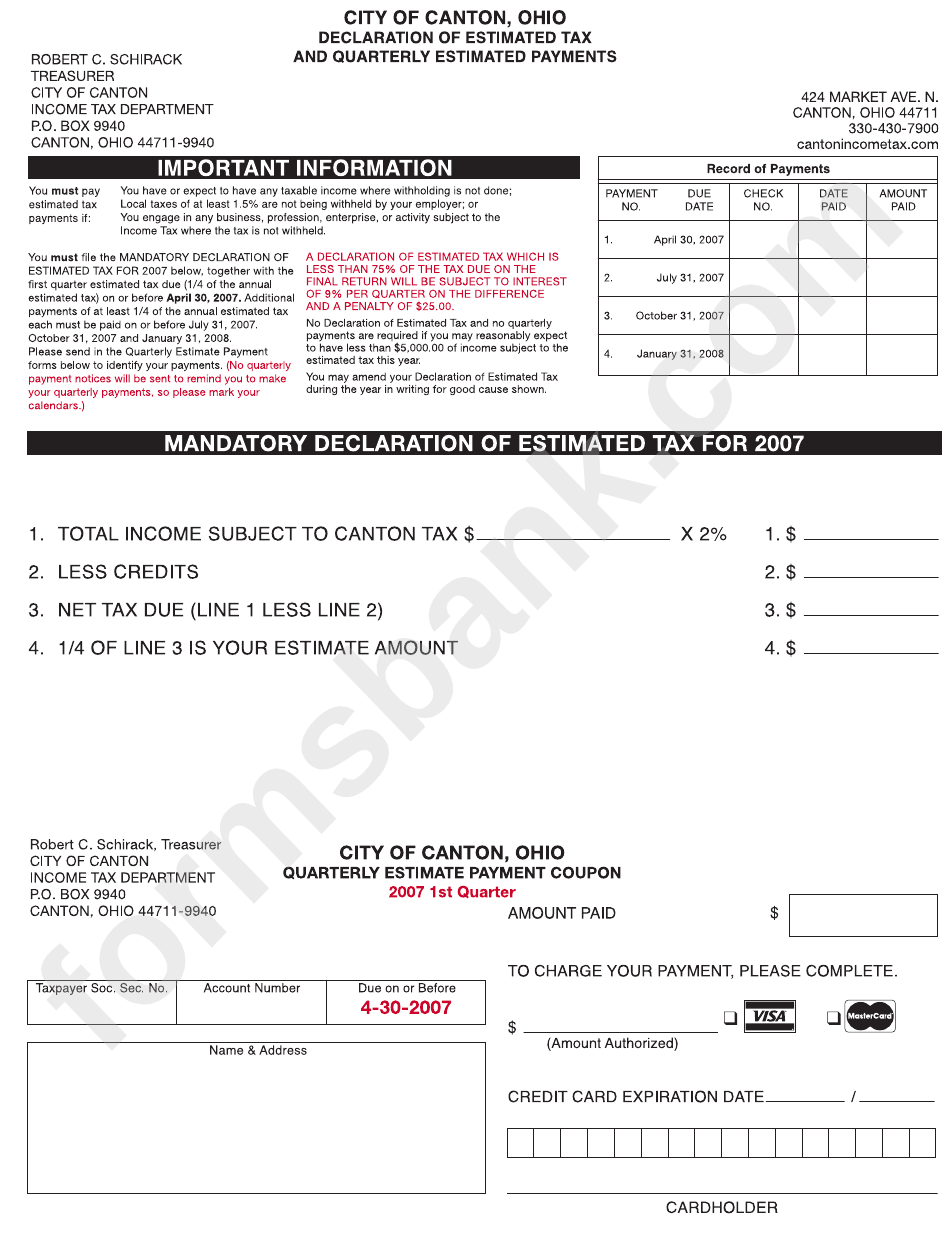

First estimated tax payment for 2025. In general, quarterly estimated tax payments are due on the following dates in.

In 2025, businesses in new york city have several important tax deadlines beyond the april 15th state and federal returns deadline.

New York Estimated Tax Payments 2025 Vita Domeniga, New york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. The free online 2025 income tax calculator for new york.

Estimated Tax Payments 2025 Forms Cicily Guinevere, Estimated income tax due dates for tax year 2025 are as follows: You must send payment for taxes in new york for the fiscal year 2025 by april 15, 2025.

Ny State Estimated Tax Form 2025 Jody Rosina, Those who want to pay by mail should send. The new york tax estimator lets you calculate your state taxes for the tax year.

Nys Estimated Tax Payments 2025 Nelly Yevette, The new york tax estimator lets you calculate your state taxes for the tax year. New york state requires taxpayers to make estimated payments if $300 or more in new york state, new york city, and/or yonkers tax is expected to be owed after deducting credits and.

New York Estimated Tax Payments 2025 Vita Domeniga, The extension deadline is october 15, 2025, to file your. For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines.

How To Make Estimated Tax Payments 2025 Tina Adeline, Effective december 1, 2011, nys will require corporations to make their estimated tax payments on line. Many nys tax filers have already received.

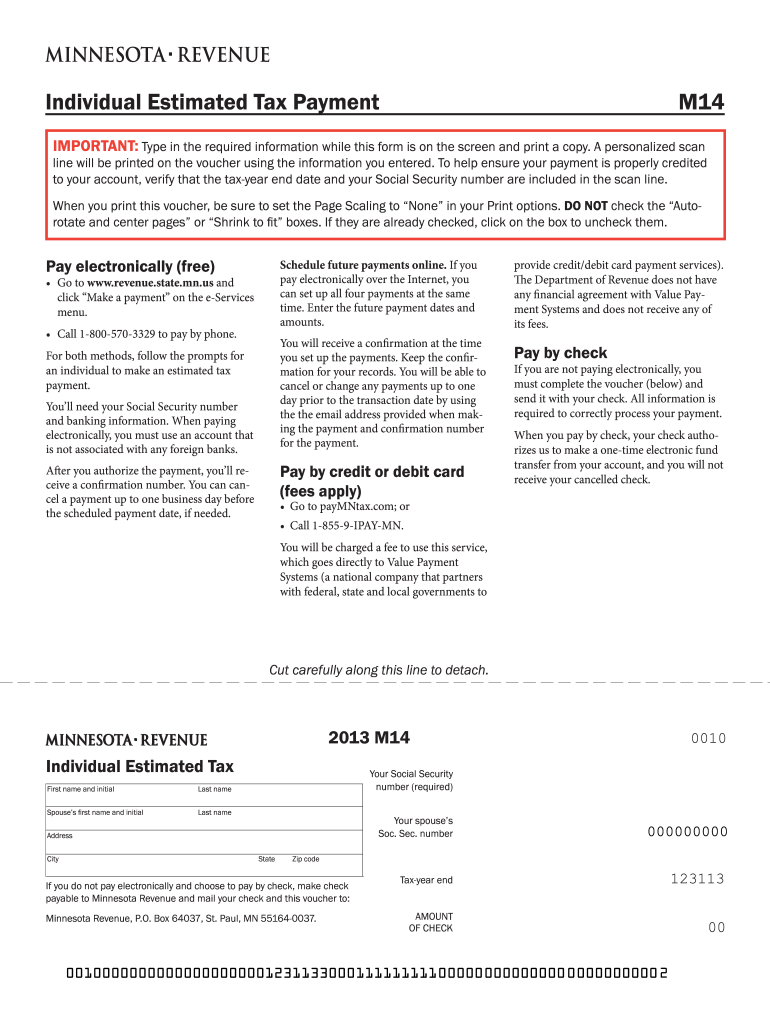

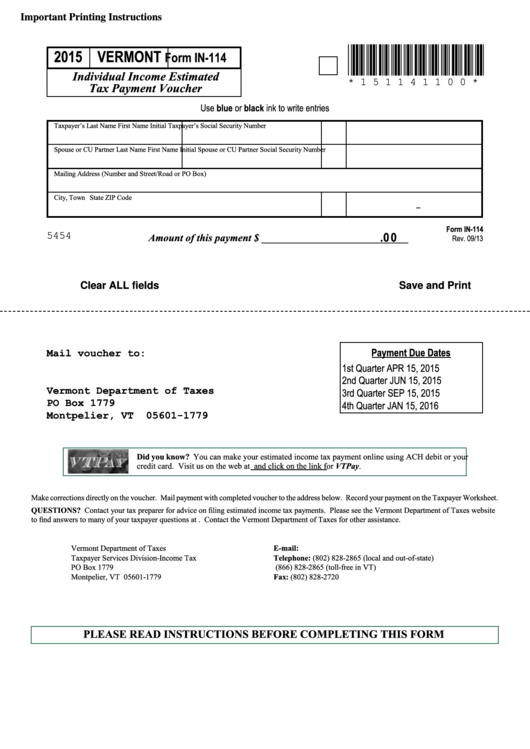

Estimated Tax Due Date 2025 Cora Meriel, Submit estimated tax payments through your new york online services account, an approved tax software provider, or by mail. Effective december 1, 2011, nys will require corporations to make their estimated tax payments on line.

New York State Itemized Deductions 2025 Pia Leeann, Find the additional estimated tax payments (date paid defaults to. Use our income tax calculator to find out what your take home pay will be in new york for the tax year.

Irs Estimated Tax Payment Form 2025 Deana Estella, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. You must send payment for taxes in new york for the fiscal year 2025 by april 15, 2025.

Estimated Tax Payment Vouchers 2025 Jena Robbin, New york state requires taxpayers to make estimated payments if $300 or more in new york state, new york city, and/or yonkers tax is expected to be owed after deducting credits and. You can make an estimated payment online or by mail.